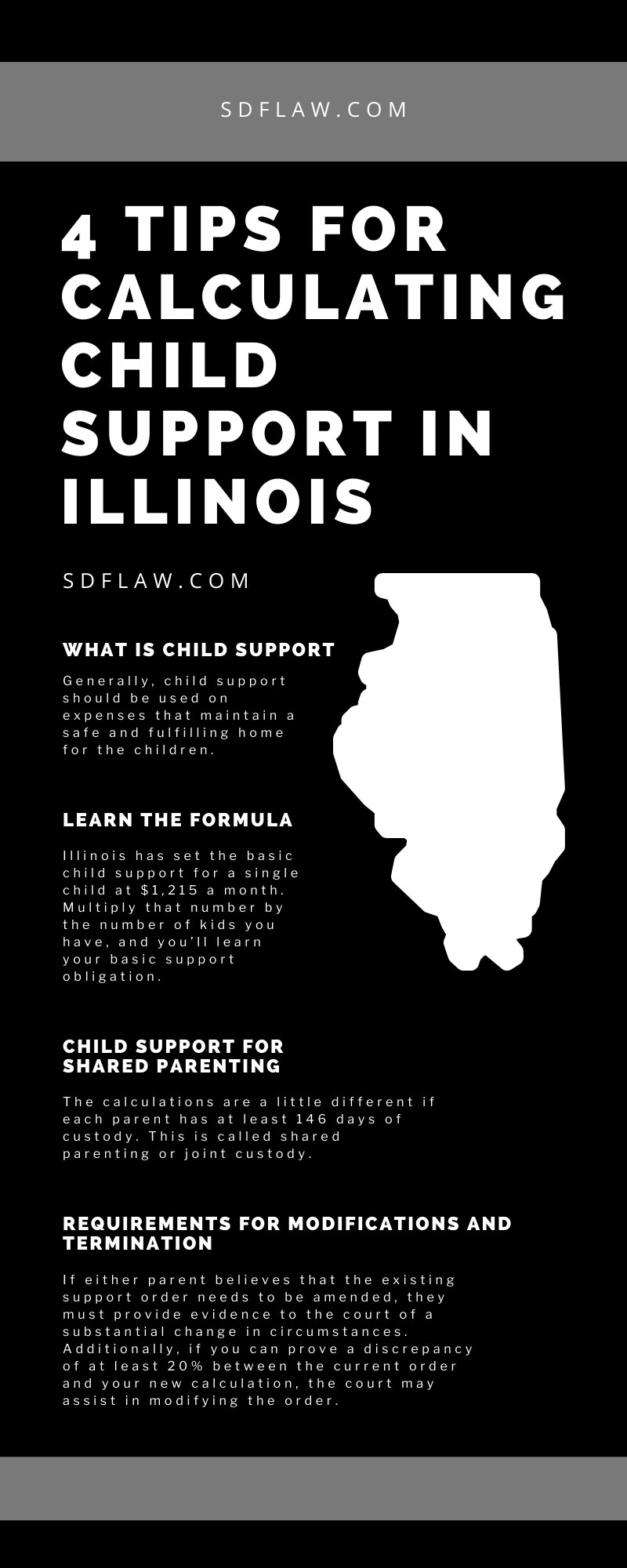

4 Tips for Calculating Child Support in Illinois

Child support calculations require you to think about a lot of numbers. It can feel overwhelming, but it’s simpler than it appears. We’re here to lighten the mental load that comes with the divorce process by clearing up some murky legal waters. Read on to learn four essential tips for calculating child support in Illinois.

Know What Is and Isn’t Child Support

If you’re new to discussions of child support, here’s a basic explanation: child support refers to the continual payments that one parent makes to the other to financially assist in raising their children. When parents separate and stop living together, the parent who lives with the child is entitled to child support from the other parent.

The point of child support is to mitigate the financial burden of child-related costs while ensuring that the child or children in question maintain a consistent standard of living. Child support can vary depending on the income of both parents as well as on the amount of time the child lives with their residential parent (more time equates to higher support payments).

What Is Child Support

There’s often confusion over which expenses are child support and which are not. Generally, child support should be used on expenses that maintain a safe and fulfilling home for the children. The following are perfect examples of expenses upon which to spend child support:

- Typical household expenses such as utilities, mortgage payments, and food

- School supplies, textbooks, and costs associated with extracurricular activities such as sports or music

- Medical, dental, and vision care

- Any basic needs of the child, including clothing and toys

What Is Not Child Support

You can’t spend child support on just anything, however. Child support money is earmarked for child-related expenses, and you therefore cannot spend it on things such as clothing, entertainment, or vacations for yourself. You should save any leftover child support from a given month to pay for future expenses.

Learn the Formula

Within the last few years, the state of Illinois changed the formula for calculating child support, transitioning from a simple percentage-based model to a more complicated income shares model. This may feel like too many numbers and percentages, but the final rate of child support is fairer and more logical, if a bit more difficult to determine.

Net Income

The first step to figuring out the child support requirements is determining both parents’ gross monthly income. Net income refers to all income, earned and unearned. Subtract any applicable deductions and adjustments (such as federal and state income taxes, union dues, and health insurance premiums), and you have your net income.

As an example, let’s say the custodial parent has a net monthly income of $3,626 and the noncustodial parent has a net monthly income of $4,221. If we add these together, we get the combined adjusted net income: $7,847.

Support Obligation

Illinois has set the basic child support for a single child at $1,215 a month. Multiply that number by the number of kids you have, and you’ll learn your basic support obligation.

Continuing the above example, if those parents have two children, the basic support obligation is $2,430.

Total support obligation adds in extra expenses such as insurance premiums and childcare—for this example, we’ll add $100 for insurance and $120 for childcare, bringing the total to $2,650.

Share of the Obligation

Don’t worry—we’re nearing the end of our calculations! Divide each parent’s net income by their combined net income. For the custodial parent, $3,626 ÷ $7,847 = 46.2%, and for the noncustodial parent, $4,221 ÷ $7,847 = 53.8%. Those percentages represent each parent’s percentage of contribution.

Finally, take those percentages and multiply them by the total support obligation—this is the number each parent needs to pay in child support.

Custodial parent: 46.2% x $2,650 = $1,224.30

Noncustodial parent: 53.8% x $2,650 = $1,425.7

This means that the noncustodial parent pays the custodial parent $1,425.70 each month for child support.

Child Support for Shared Parenting

The calculations are a little different if each parent has at least 146 days of custody. This is called shared parenting or joint custody. The first steps for calculating net income are the same, but the total support obligation is multiplied by 150% per child (from $1,215 to $1,822.50). For two children, that’s $3,645.

Take the same share of the obligation percentages (46.2% and 53.8%) and multiply them each by the new support obligation.

Custodial parent: 46.2% x $3,645 = $1,683.99

Noncustodial parent: 53.8% x $3,645 = $1,961.01

Determine Final Payment Amounts

Based on the terms of the custody agreement, each parent has a certain percentage of days with their children. In this example, we’ll say that the custodial parent has the kids 60% of the year and the noncustodial parent has them for the remaining 40% of the year. Multiply the support obligations by the other parent’s percentage of time to determine each parent’s new obligation.

Custodial parent’s obligation: $1,683.99 x 40% = $673.60

Noncustodial parent’s obligation: $1,961.01 x 60% = $1,176.61

Finally, subtract the custodial parent’s amount from the noncustodial parent’s amount: $1,176.61 - $673.60 = $503.01. This is the amount the noncustodial parent must pay the custodial parent every month. If the number had been negative, the custodial parent would need to pay the noncustodial parent that amount each month.

Requirements for Modifications and Termination

If either parent believes that the existing support order needs to be amended, they must provide evidence to the court of a substantial change in circumstances. Additionally, if you can prove a discrepancy of at least 20% between the current order and your new calculation, the court may assist in modifying the order.

Child support obligations end when a child turns 18—that is, unless they’re still enrolled in high school full time. Child support obligations could also extend beyond this point if a child is incapable of self-support. For help with all of this, consider hiring a child support attorney in Chicago—they’ll know what to do.

Now that you know our four tips for calculating child support in Illinois, figure out who owes what and set up your children for the best life possible.